Business need

Reasonable spending of money and savings leads to the creation of new financial instruments. Thus, it becomes necessary to connect new units to the personal account, which keep these costs under control. Further progress in this direction is based on the development of artificial intelligence, that deserves close attention to this sphere.

solution

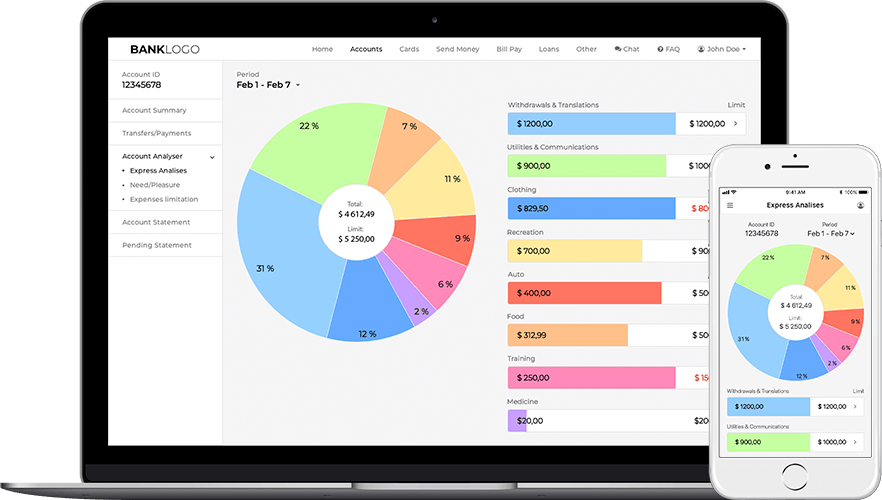

Based on the charts, the customer can monitor and analyze his segmented costs online. What is more, he can assess the payments on the basis of utility and satisfaction.

The application includes the following features:

- Adding different stores and companies into the database;

- Setting up the bank segments;

- Automatic and manual segmentation of customer costs. Creation of the own segments by the client;

- The history of the client’s expenses;

- The user’s assessment of the payment based on the level of necessity and satisfaction;

- Setting limits on the level of expenditure by segments;

- The block of the analysis of user expenses.

Softarex Technologies set a challenge to create, develop and connect a solution for the segmentation of customer costs based on its priority and necessity with subsequent analysis of the obtained data.

What was achieved:

- After extensive research and in-depth analysis of the sphere, the developed solution was integrated into the mobile and web application of the bank. This allows the bank’s customers to better understand their expenses and analyze their feasibility, which is based on the history of payments and the costs division of into segments.

- The app allows bank’s customers to approach the issues of savings more carefully and to carry out daily expenses more rationally.

Technologies

- Java

- PostgreSQL

- React.JS

- RESTful API

- ReactNative for iOS

- Android Cross platform

Project Results

This application provides all the necessary functions for users to analyze their expenses. It is worth noting that the app is useful for both parties: banks receive a powerful tool to help their customers in the field of savings, and the users get an efficient mode to keep their expenses under control.

Most importantly, thanks to the developed application, the bank’s customers can monitor and analyze their expenses, understand where they make the highest expenses, and where – the necessary ones. What is more, they can check which restrictions they have and how much they can still spend.